Revolut grew up tremendously in the past years, and it’s now one of the biggest leading fintech companies. The attractiveness of Revolut is based on its digital banking approach. Actually it goes beyond digital banking now, as it also allows investing, currency conversion and a lot more, so basically it’s a set of financial management tools. I signed up for it recently because I needed one of their feature, the option to create one-time usage debit cards. I didn’t trust adding my own CC into Aliexpress, so adding a one-time CC sounded perfect. So if you haven’t signed-up for Revolut yet, I can tell you some of its advantages over regular banking:

- Convenience. Revolut is truly convenient to mange your finances. You install it on your Android smartphone (or the other one) and you’re good to go once you’ve verified your identity. With features such as instant payments, budgeting tools, and easy currency exchange, users can take control of their money with minimal hassle.

- Cost-efficiency. Traditional banks are greedy, way too greedy. They have fees for anything, especially high ones for international transactions or currency exchange. Revolut, on the other hand, typically offers lower fees or even fee-free transactions for its users, making it a cost-effective alternative.

- Global accessibility. Revolut works everywhere, I’ve used it abroad with ease, and the fact that you can use multi-currencies in it it’s quite the bonus.

- Innovative features. Revolut continuously adds new features and services to earn a chunk from other industries as well. Like for instance the cryptocurrency trading or stock trading, or getting cashback rewards for purchases.

- Security. Their Android app comes with a lot of security features to be sure no one gets access to your Revolut account even if you lose your phone. Has advanced security features such as biometric authentication, instant card freezing, and transaction notifications.

- Financial management tools. Revolut provides users with insights into their spending habits, budgeting tools, and customizable savings features, empowering them to make informed financial decisions and improve their financial health.

Now, if you’ve decided to sign-up, Revolut offers sign-up bonuses that vary from country to country and you can use the following referral link to see what your bonus will be: Revolut sign-up bonus

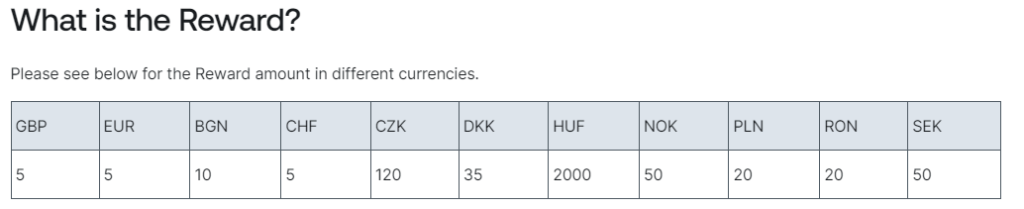

The most common sign-up bonus they offer is the referral bonus. Basically if you sign-up to Revolut via a link that another Revolut user sent you, they referral gets a bonus and you get one as well. Again, this might vary from country to country, but usually the person that signs up should receive the equivalent of $5 under certain conditions. Here’s a table that shows the bonus you receive when signing up, depending on the country:

Now, there are some requirements when you sign-up via a referral link to receive the bonus:

- Create a Revolut account using your unique referral link here: Revolut sign-up bonus

- Verify their identity and pass the Know Your Customer (KYC) checks

- Connect another bank account or use a bank card to add some money to your Revolut account (can be the minimum amount)

- Order a physical Revolut card (delivery fees may apply)

- Complete 3 purchases of at least $3 each with the Revolut card (Note: purchases can be done with a virtual card while you wait for the physical one)

- All before May 7, 2024 8:59 PM GMT for the referral link above

Who qualifies for the Promotion? To participate in this Promotion, both the Referrer and the Referee must meet the minimum age requirement for their respective market:

- For residents of Belgium, Denmark, Estonia, Finland, Latvia, Norway, Sweden, and the United Kingdom, the minimum age is 13 years.

- For residents of Austria, Bulgaria, Lithuania, and Spain, the minimum age is 14 years.

- For residents of the Czech Republic, France, Greece, and Slovenia, the minimum age is 15 years.

- For residents of Germany, Hungary, Ireland, the Netherlands, Poland, and Romania, the minimum age is 16 years.

Now, I cannot guarantee that the Revolut sign-up bonus will be added to your account, because Revolut changes their bonuses/promotions so often and those vary a lot by country. For instance, below are other current promotions/bonuses that Revolut offers in different campaigns and countries:

- Join Revolut and get a £20 welcome bonus. This Revolut sign-up bonus is only for new UK customers. If you’re from the UK, you have to create a Revolut account by adding your phone number on the page mentioned above, and you must spend £0.01 before 14 April 2024 to redeem.

- Revolut x Vodafone Promotion. This promotion only applies to residents of Romania. When you sign-up you get a 100 RON signup bonus and also a 2-month premium subscription for free. You have to sign-up for Revolut from the Vodafone app.

- Revolut x Kiwi.com Promotion. You have to be a US resident to benefit from this Revolut sign-up promotion. US customers who sign up will be eligible to receive a Cashback Offer of up to $40.00 USD on physical or virtual Revolut card payments made on Kiwi.com during the Cashback Period.

- Revolut x UNiDAYS Promotion. As part of the Revolut x UNiDAYS Promotion (“the Promotion”), Revolut is offering customers and potential customers of UNiDAYS in the United States the opportunity to sign up to Revolut for the first time and receive a 2 months subscription to Revolut Premium, without the monthly fee; and a Sign Up Bonus of $20 USD deposited directly to your new Revolut account.

- Revolut <18 Referrals Promotion. As part of the Revolut <18 Referrals Promotion, Revolut is offering certain Revolut <18 teenage users the opportunity to refer other teenage users to Revolut <18 and for both to receive a cash reward of $6 or equivalent in other currencies.

- Revolut x Partner Sign Up Bonus . Eligible only if you’re 18 years or older and a resident of the United States (with a valid US residential address). You have to order a physical card and make one (1) Qualifying Transaction of at least $1.00 USD or more.