Overview

Financial responsibility, two words that unfortunately mean nothing to a lot of people. It is my strong belief that if the majority of people would’ve been financially responsible the current recession would’ve been averted. Being financially responsible means basically to spend less than you make. Even if it sounds very simple, it’s something that not many people do. Maybe is the temptation of receiving a new credit card, the desire to change your car, the need to buy a new house or maybe just a bad habit. A lot of us spend more than we make simply because we’re in a system that allows it.

Financial institutions make huge profits, be it in times of economic growth or depression, by encouraging people to get in debt. Sure, we give you a $300,000 house and you only pay $1,500 monthly for the next 30 years, your credit rating is excellent. Being able to pay your monthly credit fees does not make you financially responsible. In theory, you shouldn’t even get a credit, but that’s a different story. ‘Rich dad, poor dad’ is a book that every 10-year old kid should read it, as it explains the basics of financial responsibility and gives you advices on getting financially balanced. My favorite advice is that of building capital instead of debt. It all starts with how you manage your money, your income versus your expenses. Here are some basic tips on how to manage your finances:

- Set a budget. For every month you should have a budget set in place. A budget is the maximum allowed amount of expenses you should have. By setting a budget, you will limit your unnecessary instincts to buy something that you really don’t need if you know that you are almost to the upper limit of your budget or risk of getting over. I usually set my monthly budget to be half of my income and try religiously to stay on track. So don’t set your budget to be the same amount as your income, otherwise you won’t save any money at all. At the end of each month analyze how well set your budget was, did you exceed it or actually spent less? This will help you adjust it for the next month.

- Track expenses. Now this is the most overlooked part in managing your finances, you don’t track all your expenses and just rely on ‘as long as there’s still money left, that’s ok’. That’s wrong because tracking down expenses will help you find out if there are unnecessary expenditures that you could cut down and help stay within budget. Track your expenses, all of them, and you’ll find out where most of your money go. As a family guy I know how difficult it is to track expenses, as your wife will spend money, your kids will too and if you’re unfortunate enough to still have her live with you, your mother-in-law. But you have to track all their expenses and the best way to do so is write down at the end of the day how much you spent and on what. Helps to keep receipts if you want to track expenses at the end of the week, but you should write down everything, including stuff that you buy with cash (so your bank account statement won’t be enough).

- Obey the limit. If you’ve set a budget, stick with it. Thus, when you get close to reaching its limit try to find ways to lower your expenses. Maybe you can give up that gym membership you pay for but only visit monthly, or newspaper subscription that you get delivered daily but the same news you could read online, or any other expense that isn’t vital. If you wrote down all your expenses you will find patterns on what things you could save some money on. When you buy things try to find the best deal for that item. There’s price comparison search engines online (just type and search) that will let you find the lowest price for the item you want to buy, there’s also websites that post deals/discounts/coupons for various ecommerce websites – visit those too when trying to save some money on a particular item. Don’t go shopping too often, just when you run out of supplies. Before going to buy things, make a shopping list and stick to buying only what’s on it.

- Use a system. Now tracking expenses by writing them down on paper is time consuming. That’s why you should use a system to track expenses and the best one is already in your pocket – your smartphone. There are various tracking apps that once installed on your smartphone will allow you to track expenses, and AntSaver is one of them

The app

Antsaver is an app designed mainly to track the expenses for the whole family, not only for an individual. Ants are extraordinary insects and their social behavior allows an entire colony to function as a whole, creating the perfect gatherer. They know how to save enough food to survive in harsh seasons and that’s the relation with the app’s name, ants know how to save resources thus AntSaver helps you save money.

With Antsaver you create an account and then add family members via their online system called the Anthive. When you’ve added your entire family to their system, you login on your smartphone to your Anthive account as one of the family members. Then you do the same for all your family members’ smartphones, you log them into Antsaver switching to their own account so that you can track what everybody is spending.

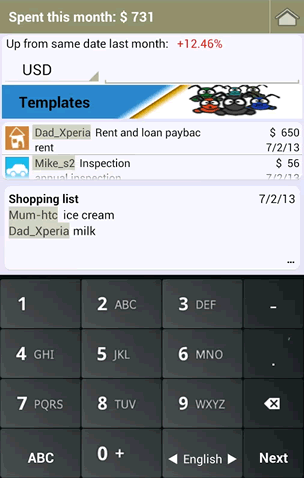

Main dashboard of AntSaver

As your family adds expenses via their own accounts, you’ll be able to synchronize your phone with the online system and you’ll see everything that was added. Not only that, but you can have shopping lists in Antsaver that get synchronized on all your devices. Thus when your wife wants you to buy milk there’s no need to yell at you from the other room to write it down, what brand and fat percentage, as she can easily pull out her phone and start adding items on the list. When you’re out shopping you can simply tap on an item and it will be marked complete. It’s as easy as it sounds and below is a more detailed list of its features:

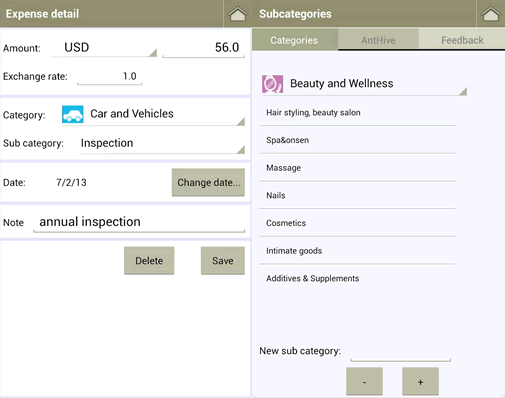

- Expense tracking. The core feature of Antsaver is expense tracking. Fire up the app and from its main dashboard you can start adding expenses, no need to open don’t-know-what menu, the app is ready right from its start. The dashboard will also show you how much you’ve spent this month, the percentage of change compared to the previous month and the items on the shopping list. At the top you’ll see the currency and a field that’s waiting for your input, tap on it and you’ll see the keypad showing up for you to enter the amount you spent – before saving it will ask you more details on what that expense was for.

Adding expenses and managing subcategories

- Shopping list. The app has a shopping list that’s synchronized across all devices in the ‘anthive’, meaning from all your family members. Thus your wife can add things to buy, your son, your mother-in-law and finally you too. When the app syncs with the online server the shopping list will show up on the dashboard of all the devices. You can add an item by entering its name and optionally adding a note to be attached to it. The item will show up in a listview with the name/note as well as date entered and which family member added it. You can tap on an item and ‘mark as purchased’ if it was already bought.

Shopping list management

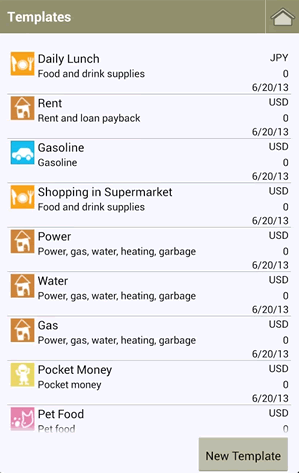

- Expense templates. Each expense is different and that’s why Antsaver provides templates. The templates are an easy way to enter recurring expenses, such as rent, utilities, food, gas, food for your pet and so on. There are several templates included by default but you can also create your own template and thus for it you’ll see only the fields you select.

Expense templates

- Backup and restore. The online ‘anthive’ acts as a backup destination too, so it’s not used only for synchronization. All your account information is backed up online thus in case your device has to be reset to its factory settings or you’ve uninstalled the app by mistake, you can restore it after reinstalling the app.

- Online synchronization. It wouldn’t be a true family expense tracking system if it didn’t have online synchronization. With this you can have the app installed on several devices and all will synchronize their data to the online server. This way all family members can work on the app in the same time, as all the data will be saved and shown on all devices.

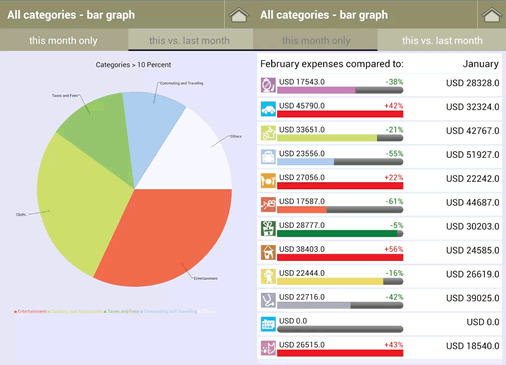

- Reports. Charts will help you understand better how much you spent over time and on what you spent the most money. Since expenses can be grouped in categories and subcategories, you can see where most of your money went to. You can see pie-charts with expenses by category for this month or in comparison with the previous month as bar graphs, as well as see all the money you spent on a month-by-month graph filtered by date, category and subcategory.

Reports for expenses

Conclusion

With Antsaver you get an expense tracking app and a shopping list management one. If you get into the habit of writing down what you spend and sticking to budgets you’ll be able to save some money as it never hurts to have some economies stacking up in a bank account. The app is free and still in its infancy, but more features will be added thus if you have any suggestions feel free to add a comment and the author will take it into consideration.

You can read more about Antsaver on the offcial website or simply download it directly from Google Play: Download Antsaver.

Name: AntSaver

Developer: Aliz

Size: 1.3Mb

Package: com.antsaver.android.apk

Version: 1.0.1

Last update: August 12, 2013

Price: Free