Overview

In some countries (US especially), if you use your car for business purposes you are allowed by federal tax law to deduct the costs associated with the business mileage, as long as you’re not 100% reimbursed for those expenses. It doesn’t matter if you’re working for someone else or you are self-employed, what matters is that you clearly keep count of your work related mileage and associated expenses.

There are basically two ways to calculate work travel related expenses:

- keep receipts of every expense (i.e. licenses, gas, oil, tolls, lease payments, insurance, garage rent, parking fees, registration fees, repairs, and tires) and of the percentage of mileage that is business related. You’ll receive a more accurate deduction if you keep track this way, but it’s much more tedious since you have to keep every receipt.

- second option is to multiply the miles you drive for work with the IRS standard mileage rate which, depending by country, varies and is changed frequently. This is obviously less hassling, but you might get less money.

Either way, you will need to keep track of your mileage. The basic way I’ve done it a couple of years back when I needed to do so, was by writing on paper the details of each work related trip. The date/time, mileage when I got in the car, mileage when I got out and so on. After a while it became annoying so I used a recorder to dictate my mileage details and at the end of each month I would sit down and start listening to those recordings to write down the mileage info in an Excel sheet. I tell you it was a painful task, as tedious actions make you forget things. Sometimes I would forget to start the recording when I got in the car and remembered after a while to do it when I was already on my way, other times I would forget completely, and obviously the mileage information wasn’t very accurate. Not to mention the time wasted to do all this. Luckily there are now various apps for smartphones that can keep track of mileage in a simpler manner, and one of the best apps at doing so is EasyBiz Pro as you can see in this video presentation below:

http://www.youtube.com/watch?v=l8yJGxcQWIQ

The app

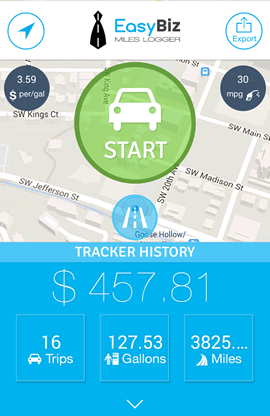

EasyBiz Pro is a must-have app for commuters that are eligible for mileage cost reimbursements. The hassle I mentioned above for keeping track manually of your mileage is handled beautifully by EasyBiz Pro. The part I like most is the simplicity of the app, as you only have to hit a start button when the trip begins, and a Stop one when it ends. The app uses the GPS of your device to track your location and calculate thus the distance accurately. Aside mileage, it will also keep track and calculate how much money is spent on gasoline while you travel for business purposes. For this purpose it will ask you initially to set the price of gasoline and the mpg of your car (miles per gallon).

EasyBiz Pro also comes with reporting functionality, as you’ll be able to see charts for mileage, gas and cost. The data it gathers can be exported, either as a locally stored file or online directly in your Google Drive (with the possibility of exporting automatically). The simplicity of the app is one of its strongest points as what’s important for the user is to record accurately the mileage without spending too much time handling the actual recording. These are the most important features of EasyBiz Pro:

- Accurate mileage tracking. EasyBiz Pro uses the GPS of your smartphone to detect accurately your location when you tell it to record the mileage. The first thing it will do is detect your location, so that when you start it a route will be created based on your dynamic location. Since GPS will consume extra battery, you can opt for the manual entry of your routes and let the app just calculate the mileage and associated costs. You can enter manually a start location for a route, “pin drop” on the end location and set the mpg/gas cost for that route. That is if you don’t want to let it track all this automatically.

The main dashboard of EasyBiz

- Simplicity. EasyBiz Pro was up for the “2013 Webby Awards for IOS and Android” plus was Ranked on iOS’ “Best New Apps List” and “Top 200 Free Apps” for Business (it was available first for iOS and only recently ported to Android). One of the reasons for ranking this high is simplicity, users still prefer simple apps that do perfectly what they’re intended for. EasyBiz Pro was built on the K.I.S.S principle and it paid off. I like how childishly easy it is to track mileage with it.

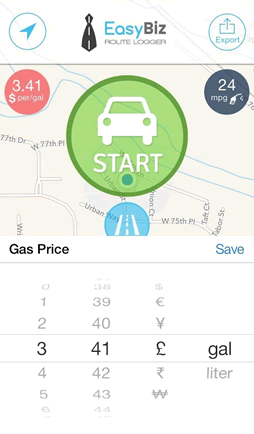

- International. The US is one of the few countries that use non-metric systems, along with Liberia and Burma. More than 120 other countries have adopted the metric system. EasyBiz Pro handles that too, as you can use both metric and non-metric measurements. It has miles and also kilometers, miles-per-gallon but also kilometers-per-liter, so it can be used internationally. Plus, it supports multiple currencies for setting the cost of the gas and seeing associated reports.

You can set prices in various currencies

- Reporting charts. EasyBiz Pro offers easy to read charts and analytics for your mileage , associated cost, gas consumption and routes. From its main dashboard you can tap on tracking history and you’ll be able to see the bar-charts with details by month and day for mileage, consumption and cost.

Reporting charts and analytics.

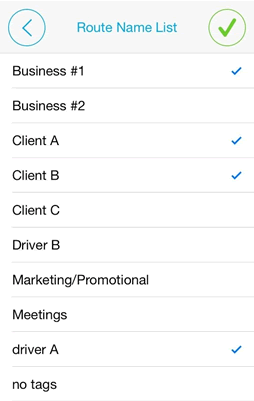

- Filtering. While you’re looking at a report you can also filter it by date and tags (routes). This is useful when you want for instance to export only a particular set of data, not the entire entered mileage information.

- Routes and tags. EasyBiz Pro saves automatically each trip as a route, this way allowing you to save recurrent trips. If you do one trip regularly you can save it with a particular name and just re-use that name whenever you take it again. Labeled routes (equivalent of tags) are also useful when exporting data.

Routes in EasyBiz, a way to tag your trips.

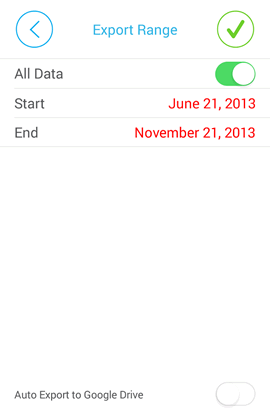

- Export data. After you’ve selected a particular filter for the saved data (i.e. a date range or a labeled route), you can export that to a CSV file. This way you can import the file in your accounting software, Excel or any other program that supports this format. The data can be automatically backed up in your Google Drive to be sure it’s kept safe.

EasyBiz allows you to export the data.

Conclusion

EasyBiz Pro is simple and does its job very well. I’m sure it will embrace success on Android as they did on iOS for having a clean interface with the essential functionality placed right where you need it. The app saves commuters a lot of time and its cost of $4.99 is recovered in no-time if you judge by how helpful it is. You can get EasyBiz Pro directly from Google Play: Purchase EasyBiz Pro.

Name: EasyBiz Pro

Developer: EasyBiz

Size: 1.7Mb

Package: com.forixusa.bizmilepro.android.apk

Version: 1.8

Last update: January 16, 2014

Price: $4.99